Headquartered in Florida: 1400 International Parkway South, Lake Mary, Florida 32746

© RPFunding.com | RP Funding, Inc. NMLS #70168

| Licensed by the Alabama Consumer Credit license #22091

| Licensed by Arkansas Securities Department license #107368

| Florida Licensed Mortgage Lender

| Licensed by North Carolina Office of the Commissioner of Banks license numbers L-164400 and S-164401

| Licensed by Ohio Division of Financial Institutions license number RM.850251.000

| Licensed by the Mississippi Department of Banking and Consumer Finance

| Licensed by Oklahoma Department of Consumer Credit license numbers ML010607 and ML012564

| Tennessee Licensed Mortgage Lender #108621

| Licensed by the Texas Department of Savings and Mortgage Lending NMLS 70168

| FHA Lender ID 263150002

| Mortgage Lenders Investment Trading Corporation dba RP Funding, Inc.

| NMLS Consumer Access

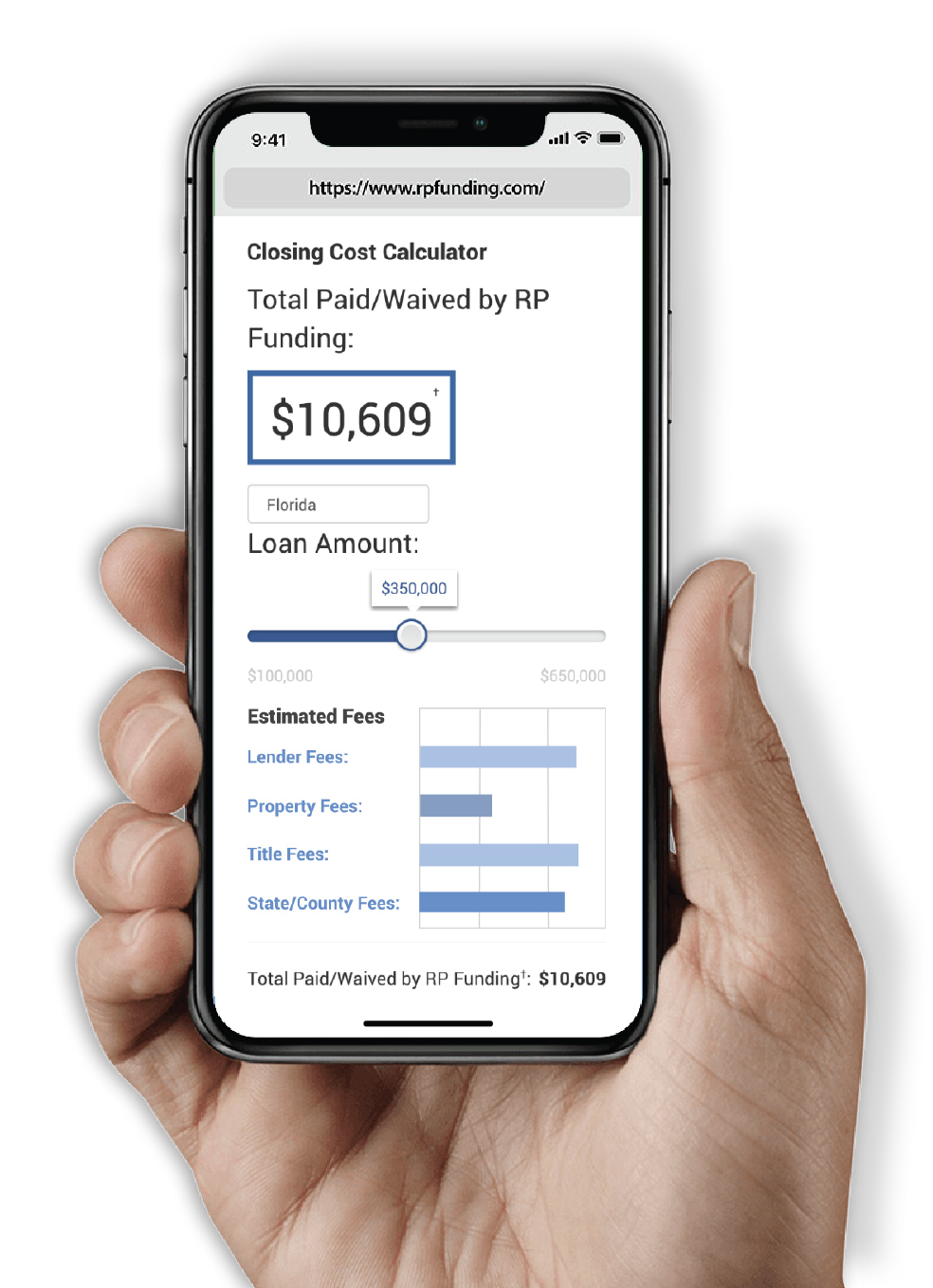

* CLOSING COST PROGRAMS: Offer to pay Closing Costs is subject to borrower’s qualification for the No Closing Cost Refinance Program or Closing Cost Credit Program. Not all borrowers will qualify. All programs valid only in Florida. Additional terms and conditions apply, call for details. Closing Costs Programs cannot be combined with any other offer. For any Closing Cost Program, RP Funding will issue a lender credit at closing in the amount determined by the Closing Cost Program for which borrower qualified. Not valid on Non-Qualified mortgages (Jumbo, Alternative Document, Reverse Mortgage, Manufactured Homes, Condos, or HELOC mortgages). The following charges always remain an expense to the borrower and are not Closing Costs: rate discount costs/discount points, prepaid items (including mortgage insurance premiums, interest, property taxes, homeowners insurance, and any escrow accounts), Upfront Mortgage Insurance Premium (UFMIP), funding fees, the payment of a mobile notary fee if the selected closing agent has an office which serves the area, or additional non-standard services requested by the purchaser.

No Closing Cost Refinance Program: Conventional loans only. Borrower must provide prior owners title policy, prior valid survey and establish an impound account to qualify. Borrower elected Discount points/Rate buy downs are ineligible. Borrower must meet following eligibility requirements: primary single-family residence, fixed-rate, refinance transactions, with loan amounts above $250,000 and below conforming limits at less than 80% LTV, and credit score of 720 or higher. Borrowers who receive CASH OUT at closing or to payoff any debt other than prior first mortgage must have LTV below 70%.

Closing Cost Credit Program: For borrowers who do not qualify for a No Closing Cost Refinance, RP Funding will offer a Closing Costs Credit subject to the following conditions: fixed rate refinance transactions on loan amounts above $50,000 and below conforming limits, for borrowers with 640 or higher credit score. Actual amount of closing cost credit will vary and be disclosed to the customer on the Loan Estimate at time of Rate Lock.

** $1,000 Mortgage Challenge/Guarantee requires a minimum loan amount of $100,000 and applies to Fixed Rate Loans only. This Challenge/Guarantee is not applicable to Jumbo Loans and does not apply if borrower is declined by R P Funding for not meeting credit or income program guidelines. Borrower must provide Loan Estimate Disclosure to R P Funding from competing lender on the same day the competitor's terms are offered. Loan program offered by competitor must be a program R P Funding currently offers. This price match challenge / guarantee may be combined with other R P Funding offer(s) upon Lender's approval. This offer does not apply to prior locks or terms, and R P Funding must have an opportunity to beat the terms. In the event that R P Funding is unable to beat the terms of the competing lender, borrower must provide the final executed Closing disclosure, the first page of mortgage note after closing and funding, and the lock-in agreement dated the same day terms are presented to R P Funding, all of which will be used to verify competing lender's terms have not changed at closing. The $1,000 Mortgage Challenge/Guarantee is not applicable if the loan closes on terms different than those detailed in the Loan Estimate Disclosure provided to R P Funding. Change in terms include, but are not limited to, changes in loan amount, loan program, fees, discounts, lender credits, rate, APR, buy-downs, years of term, origination, down payment, seller or any interested party credits, and within the time of the competitor's initial lock in, or any other material loan changes not specifically mentioned here. The price match challenge / guarantee is inclusive of ANY and ALL R P FUNDING lender credits.

Website not valid or intended for Washington residents/customers. Website not valid or intended for New York residents/customers. Website not valid or intended for California residents/customers

APPLY

APPLY